Westerra Credit Union: Your Trusted Partner For Financial Growth

In an increasingly complex financial landscape, finding a banking partner that truly understands your needs and prioritizes your financial well-being is paramount. For residents of Colorado, particularly in the Denver metropolitan area, Westerra Credit Union stands out as a beacon of stability, community focus, and innovative service. With a rich history spanning nearly a century, Westerra has consistently evolved to meet the demands of modern banking while staying true to its foundational principles of member empowerment and local commitment.

From its humble beginnings as a teachers' credit union to its current status as a leading financial institution, Westerra has built a reputation for trustworthiness and comprehensive financial solutions. This article delves deep into what makes Westerra Credit Union a distinguished choice, exploring its history, the breadth of its services, its commitment to security, and the unique advantages it offers to its members, all designed to help you "do money with confidence."

Table of Contents

- The Enduring Legacy of Westerra Credit Union: A Journey Since 1934

- Banking with Confidence: The Westerra Promise of Security and Stability

- A Network of Accessibility: Westerra's Growing Branch Footprint

- Empowering Your Finances: Comprehensive Services at Westerra Credit Union

- The Digital Edge: Seamless Online Banking with Westerra

- Recognizing Excellence: Westerra's Industry Accolades

- Maximizing Your Savings: How Westerra Helps You Save More

- A Community-Centric Approach: Beyond Banking

The Enduring Legacy of Westerra Credit Union: A Journey Since 1934

The story of Westerra Credit Union is one deeply rooted in community and a commitment to serving its members. Its origins trace back to 1934, a challenging period in American history, when eight visionary teachers came together to establish the Denver Public Schools Credit Union. This foundational act, born out of a need for accessible and reliable financial services for educators, laid the groundwork for what Westerra is today. This early dedication to a specific community group – teachers – instilled a member-first philosophy that continues to be the "North Star" guiding everything Westerra does.

Over the decades, the credit union grew, adapted, and expanded its reach. In 2006, a significant milestone occurred when Westerra Credit Union became the new name for the credit union formed by the merger of three of the state’s leading credit unions, including the Denver Public Schools Credit Union and Safeway Rocky. This strategic consolidation allowed Westerra to leverage combined strengths, expand its service offerings, and extend its membership eligibility beyond its original scope, making quality financial services accessible to a broader segment of the Denver, CO area community. With assets now in the amount of $1,282,218,975, headquartered in Denver, CO, Westerra stands as a financially robust institution, ready to support its members' diverse needs.

Roots in Education: From Denver Public Schools Credit Union

The legacy of its founding teachers is palpable in Westerra's operations. The initial focus on supporting educators fostered an environment of trust, understanding, and a genuine desire to see members succeed. This ethos translated into practical benefits: fair rates, personalized service, and a commitment to financial literacy. Even as Westerra grew and diversified its membership, the core principle of being a supportive partner, much like a teacher guides a student, remained. This historical foundation is crucial for understanding why Westerra Credit Union operates with such a strong sense of purpose and community responsibility, always aiming to empower its members to "do money with confidence."

Banking with Confidence: The Westerra Promise of Security and Stability

In the realm of personal finance, security and stability are non-negotiable. Westerra Credit Union places these at the forefront of its operations, ensuring that members can manage their money with peace of mind. A cornerstone of this assurance is the federal insurance provided by the National Credit Union Administration (NCUA), a U.S. government agency. Your savings are federally insured to at least $250,000 and backed by the full faith and credit of the United States government. This robust protection means that your deposits are safe, even in unforeseen circumstances, providing a critical layer of security that allows you to "do money with confidence."

Beyond federal insurance, Westerra Credit Union consistently demonstrates its financial strength and stability through sound management and strategic growth. The credit union's robust asset base and responsible lending practices contribute to its resilience. Furthermore, Westerra Credit Union has secured two industry accolades, demonstrating its financial strength and stability. Such recognitions are not just honorary; they are external validations from reputable bodies, confirming Westerra's adherence to high financial standards and its capacity to serve its members reliably for the long term. This commitment to financial integrity is a testament to their North Star, ensuring that every decision made contributes to the financial well-being and security of their members.

A Network of Accessibility: Westerra's Growing Branch Footprint

While digital banking offers unparalleled convenience, the value of a local branch for personalized service and in-person transactions remains significant for many. Recognizing this, Westerra Credit Union has strategically expanded its physical presence across the Denver, CO area. Since its founding in 1934, Westerra has grown to operate 9 branches, making quality financial services accessible to everyone in the communities it serves. This extensive network ensures that members have convenient access to a full range of banking solutions under one roof, whether for everyday banking needs, loan applications, or financial advice.

Each Westerra Credit Union branch is designed to be a hub of financial activity, providing comprehensive services in a welcoming environment. For instance, Westerra Credit Union’s convenient location on Alameda Avenue in Lakewood, Colorado, delivers a full range of banking solutions under one roof, from everyday banking and 24/7 ATM access. Similarly, the convenient Littleton location on Belleview Avenue, just west of Wadsworth, offers the same extensive suite of services. In Aurora, the branch at Quincy Avenue and Buckley Road ensures that whether you need everyday banking or 24/7 ATM access, it's readily available. Other key locations include the convenient branch on Union Blvd in Lakewood, Colorado, and the Central Park branch, conveniently located on 35th and Quebec. The convenient Parker location also offers a full range of banking solutions designed to fit your lifestyle, from everyday banking and 24/7 ATM access to mortgages. This widespread presence underscores Westerra’s commitment to community integration and ensuring that members can easily "Find your local branch location and hours, and more," making banking truly accessible and convenient.

Empowering Your Finances: Comprehensive Services at Westerra Credit Union

Westerra Credit Union is more than just a place to keep your money; it's a comprehensive financial partner offering a broad spectrum of services designed to meet diverse financial needs at every stage of life. From fundamental everyday banking to more complex financial instruments, Westerra provides solutions that empower members to manage their money effectively and achieve their financial goals. This holistic approach ensures that whether you're just starting your financial journey or planning for retirement, Westerra has the tools and expertise to support you.

The core offerings include robust checking and savings accounts, providing flexible options for managing daily expenses and building reserves. Beyond these basics, Westerra offers competitive loan products, including mortgages, auto loans, and personal loans, tailored to help members finance significant life purchases. Their commitment to member success extends to specialized financial products, such as credit cards. There are "5 advantages of Westerra Credit Union credit cards," and members can "Learn about the advantages of opening a credit card with Westerra Credit Union," including the opportunity to "Enjoy low interest rates, rewards, and more!" These benefits are designed to provide financial flexibility and value, distinguishing Westerra's offerings from many traditional banks. The goal is always to provide members with the resources they need to "do money with confidence" and build a secure financial future.

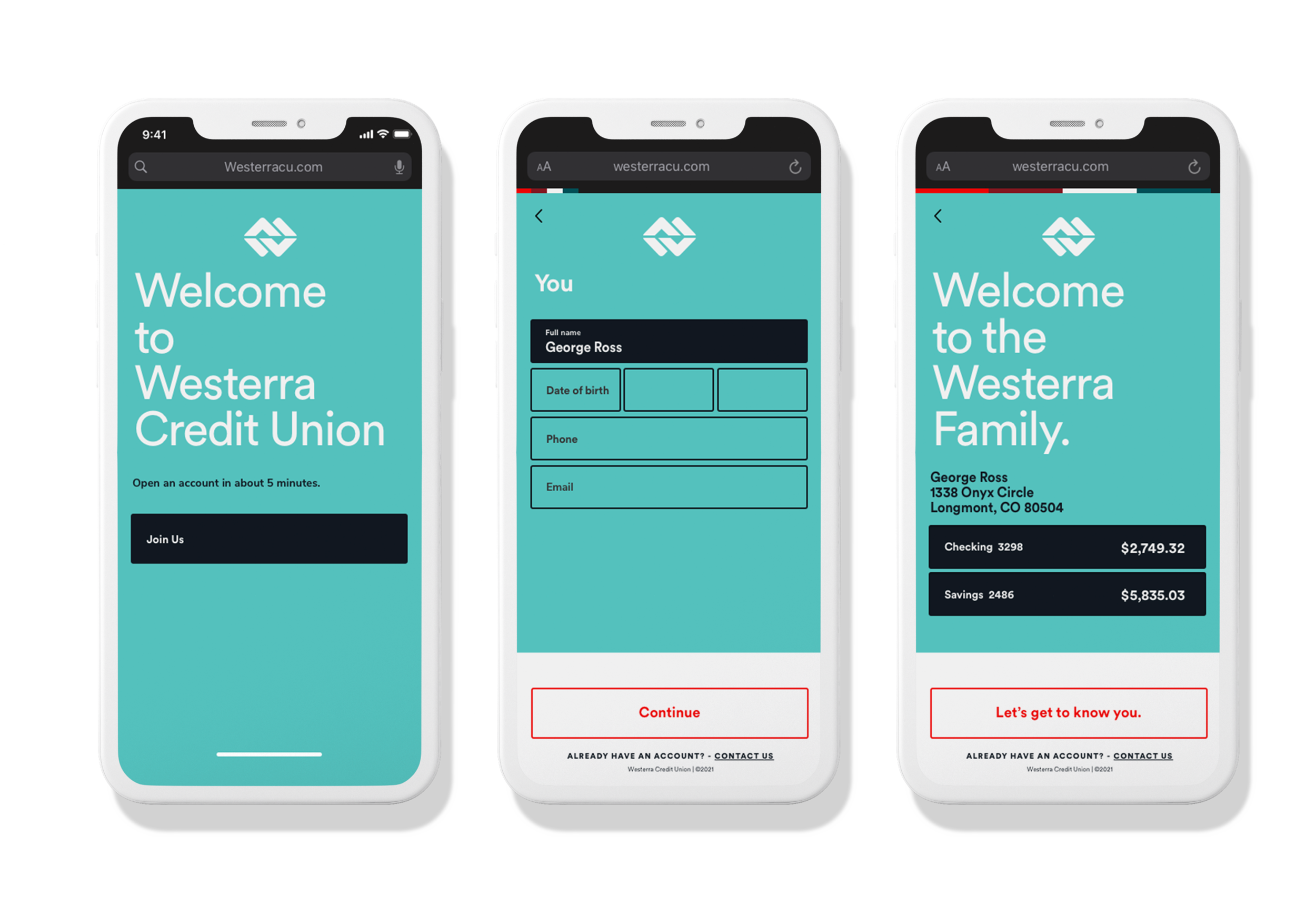

The Digital Edge: Seamless Online Banking with Westerra

In today's fast-paced world, the ability to manage finances anytime, anywhere, is crucial. Westerra Credit Union understands this need and offers a variety of online account services to make banking easy and convenient for its members. Their robust digital banking platform provides a secure and intuitive interface for managing all aspects of your financial life from the comfort of your home or on the go. This digital capability is a cornerstone of Westerra's commitment to modern, accessible banking, ensuring that members can stay on top of their finances effortlessly.

Through Westerra's digital banking, members can perform a wide array of transactions and access critical information with just a few clicks. You can easily "View your account activity, transfer funds, open accounts and more." The platform allows you to "Verify deposits and withdrawals, view account activity, print estatements, transfer funds between your Westerra Credit Union accounts, make Westerra Credit Union loan payments, view and print" essential documents. For security and service continuity, it's important to "Please verify all of your contact information by logging into your digital banking, through your profile and settings." Westerra prioritizes the privacy and security of your data, ensuring that "This information will only be used to validate your account and won't be shared with any external data services." This dedication to data protection reinforces the ability to "do money with confidence" in the digital realm, knowing your personal and financial information is safeguarded.

Recognizing Excellence: Westerra's Industry Accolades

The quality and reliability of a financial institution are often reflected in the recognition it receives from independent, reputable sources. Westerra Credit Union has consistently earned high praise, underscoring its commitment to excellence and its strong standing within the financial industry. These accolades are not merely badges of honor; they serve as objective indicators of Westerra's operational strength, member satisfaction, and overall performance, providing further assurance to current and prospective members.

One of the most significant recent achievements for Westerra Credit Union is its inclusion on Newsweek's 2024 Best Regional Banks and Credit Unions annual list. Notably, Westerra is only 1 of 3 credit unions recognized on this prestigious list, a testament to its exceptional service, financial health, and positive impact on its members and community. This recognition from a widely respected publication like Newsweek speaks volumes about Westerra's standing as a top-tier financial institution. Furthermore, Westerra Credit Union secures two industry accolades, demonstrating its financial strength and stability. These recognitions reinforce the message that Westerra is a financially sound and well-managed credit union, providing a trustworthy environment where members can truly "do money with confidence." These awards validate Westerra's unwavering dedication to its "North Star" – guiding everything they do towards member success and community betterment.

Maximizing Your Savings: How Westerra Helps You Save More

One of the primary goals for anyone engaging with a financial institution is to maximize their savings and make their money work harder for them. Westerra Credit Union is designed with this objective in mind, offering a variety of products and services that help members retain more of their hard-earned money and grow their wealth. The credit union model, by its very nature, is member-owned and not-for-profit, meaning that earnings are typically reinvested into the credit union through better rates, lower fees, and enhanced services, rather than being distributed to external shareholders. This fundamental difference often translates into tangible benefits for members.

When you "Learn more about how much you can save with Westerra," you'll discover that this commitment manifests in several ways. For instance, the previously mentioned advantages of Westerra Credit Union credit cards, such as "low interest rates" and "rewards," directly contribute to savings by reducing borrowing costs and offering tangible benefits for spending. Beyond credit cards, Westerra strives to offer competitive interest rates on savings accounts and certificates, allowing your deposits to grow more effectively. Similarly, favorable loan rates on mortgages and auto loans mean lower monthly payments and less interest paid over the life of the loan, freeing up more of your income for savings or other financial goals. By focusing on member value, Westerra Credit Union actively helps you optimize your financial position, reinforcing the ability to "do money with confidence" by making smart financial choices.

A Community-Centric Approach: Beyond Banking

While providing excellent financial services is Westerra Credit Union's core mission, its impact extends far beyond transactions. At its heart, Westerra embodies a profound commitment to the communities it serves. This community-centric approach is a direct reflection of its "North Star," which guides everything they do. It’s about more than just opening accounts or processing loans; it’s about fostering financial literacy, supporting local initiatives, and being a genuine partner in the economic well-being of the Denver metropolitan area. This deep-seated connection to the community is what truly differentiates Westerra and cultivates a sense of shared purpose with its members.

The extensive network of 9 branches across the Denver, CO area is not just for convenience; it represents Westerra's dedication to being physically present and engaged in diverse neighborhoods. Each branch, from Alameda Avenue to Parker, serves as a local resource, staffed by individuals who are often part of the same community. This local presence facilitates a more personalized and understanding approach to banking, recognizing that financial needs can vary greatly from one community to another. It's this blend of comprehensive services and genuine local engagement that allows Westerra to truly make quality financial services accessible to everyone, ensuring that members don't just bank with Westerra, but grow with Westerra.

The Local Touch: Personalized Service at Every Branch

The "local touch" at Westerra Credit Union is not just a marketing slogan; it's an operational philosophy. Unlike large, impersonal banks, Westerra's structure as a member-owned credit union fosters a more personalized and attentive service experience. When you visit any of their convenient locations, such as the branch on Union Blvd in Lakewood, Colorado, or the Central Park branch on 35th and Quebec, you’re greeted by staff who are dedicated to understanding your individual financial situation. This personalized approach means that advice is tailored, solutions are flexible, and relationships are built on trust. It’s this human element, combined with their robust financial offerings, that empowers members to "do money with confidence," knowing they have a supportive team behind them.

Commitment to Member Well-being: Financial Education and Support

Westerra Credit Union's commitment to its members' well-being extends beyond traditional banking services to encompass financial education and support. Recognizing that informed members make better financial decisions, Westerra often provides resources and guidance to help individuals navigate complex financial topics. This focus on empowerment, rooted in their founding by educators, helps members to "do money with confidence" by equipping them with the knowledge they need. Whether it’s understanding loan terms, managing credit, or planning for retirement, Westerra aims to be a valuable resource, ensuring that its members are not just served, but also educated and supported in their financial journeys.

Conclusion

From its founding by eight dedicated teachers in 1934 as the Denver Public Schools Credit Union, Westerra Credit Union has grown into a cornerstone of financial stability and community support in the Denver metropolitan area. Its unwavering commitment to its "North Star" – guiding everything they do with a member-first philosophy – has resulted in a comprehensive suite of services, a robust digital banking platform, and a widespread network of accessible branches. With federal insurance protecting your savings, and prestigious industry accolades like the Newsweek 2024 recognition affirming its financial strength, Westerra provides a secure environment where you truly can "do money with confidence."

Whether you're looking for everyday banking solutions, competitive loan rates, or personalized financial guidance, Westerra Credit Union offers the expertise, authoritativeness, and trustworthiness essential for managing your financial life. Their dedication to helping you maximize your savings and their deep-rooted community engagement make them more than just a credit union – they are a partner in your financial journey. We extend a sincere "Thank you for making Westerra your credit union." If you're seeking a financial institution that combines historical integrity with modern convenience and a genuine commitment to your well-being, we encourage you to explore the benefits Westerra Credit Union has to offer. Visit your nearest branch, explore their online services, or contact them today to discover how Westerra can help you achieve your financial aspirations.

- Springhill Suites Huntsville Downtown

- Ought Meaning

- Whatchu Talkin Bout Willis

- Beasley Funeral Home

- El Rinconsito

Westerra Credit Union - Coda Construction

Westerra Credit Union — Elliott For Hire

Westerra Credit Union — Elliott For Hire