Popular Bank: Your Guide To Seamless Financial Solutions

In today's fast-paced world, choosing the right financial partner is more critical than ever. A bank isn't just a place to store your money; it's a vital tool that empowers your financial journey, offering convenience, security, and growth opportunities. This comprehensive guide delves into what makes a "popular bank" stand out, focusing on the services, features, and customer-centric approach that define a truly exceptional banking experience. We'll explore how modern banking solutions, exemplified by institutions like Popular Bank, are designed to meet your diverse financial needs, from everyday transactions to long-term wealth building.

Understanding the intricacies of banking services can often feel overwhelming, but it doesn't have to be. A truly popular bank simplifies these complexities, providing intuitive platforms and dedicated support that make managing your finances straightforward and efficient. From opening new accounts to instant money transfers and robust customer service, the focus is always on empowering you with control and clarity over your financial life. Let's embark on a detailed exploration of the features that make a bank not just good, but genuinely popular among its users.

Table of Contents

- Online and Mobile Banking: The Digital Backbone

- Streamlined Money Transfers: Within and Beyond Popular Bank

- Opening New Accounts: Your Path to Financial Growth with Popular Bank

- ATM Access and Fees: Navigating Your Cash Needs

- Unparalleled Customer Support: The Popular Bank Difference

- Security and Trust: Safeguarding Your Finances with Popular Bank

- Why Choose Popular Bank? A Holistic Approach to Banking

- The Future of Banking: Innovation at Popular Bank

Online and Mobile Banking: The Digital Backbone

In the modern financial landscape, the strength of a "popular bank" is often measured by the robustness and user-friendliness of its digital platforms. Online and mobile banking are no longer just conveniences; they are essential tools that enable customers to manage their finances anytime, anywhere. Popular Bank understands this fundamental shift, offering a comprehensive suite of digital services designed for maximum accessibility and efficiency.

Effortless Enrollment: Getting Started with Popular Bank

Getting started with online banking should be a seamless process, not a hurdle. Popular Bank makes enrollment straightforward, recognizing that immediate access is key for today's busy individuals. To register for online banking, customers are typically guided to a dedicated link, where they can select "start here" to begin the process. What truly simplifies this initial step is the flexibility offered: the option to enroll with your ATM/debit card information will be automatically selected, providing a quick and familiar entry point for most users. However, Popular Bank also provides alternative enrollment methods, acknowledging diverse customer needs. You can also enroll with your popular line of credit, certificate of deposit (CD), or checking account information, ensuring that various types of account holders can easily gain digital access. This flexibility underscores Popular Bank's commitment to user convenience from the very first interaction.

Depositing Checks with Ease: The Popular Mobile App Advantage

One of the most celebrated features of modern mobile banking is the ability to deposit checks without ever stepping foot into a branch. The Popular Mobile Banking App exemplifies this convenience, transforming a once time-consuming task into a matter of minutes. The process is remarkably simple and secure, designed with the user in mind. First, you use your favorite pen to sign and endorse your check, a crucial step for security and validation. Then, you simply follow the next steps outlined within the app, which typically involve taking clear photos of the front and back of the endorsed check. The app guides you through the process, ensuring proper lighting and focus for successful capture. This feature not only saves time but also provides immediate access to funds, enhancing the overall efficiency of managing your finances with Popular Bank. It's a prime example of how a popular bank leverages technology to simplify everyday financial tasks.

Streamlined Money Transfers: Within and Beyond Popular Bank

The ability to move money quickly and securely is a cornerstone of effective financial management. Popular Bank offers robust solutions for both internal and external fund transfers, ensuring that your money is where it needs to be, when you need it. This flexibility is a key reason why it stands out as a popular bank among its users.

- John Wick 5 Release Date

- Priority Plus Financial

- Incredible Hulk Grey Hulk

- Padre Nuestro Prayer

- Hakone Estate

For immediate needs, you can instantly transfer money between your Popular accounts through online and mobile banking. This feature is invaluable for managing different financial goals, whether it's moving funds from your checking to savings account, or from a line of credit to cover an expense. The real-time nature of these transfers means you have instant access to your funds across your Popular Bank portfolio, providing unparalleled convenience and control.

Beyond internal transfers, Popular Bank also facilitates moving funds to accounts at different banks. To transfer funds to your account at a different bank, you can set up external accounts, a process designed to be secure and straightforward. This typically involves verifying the external account through small test deposits, ensuring that your money reaches the correct destination. For more complex transfers, such as those requiring specific beneficiary details, Popular Bank ensures clarity. When initiating such transfers, you'll need to provide the customer account name and beneficiary account number, standard practice to ensure accuracy and security in financial transactions. Furthermore, for international transfers or those involving different banking systems, Popular Bank is equipped to handle the nuances. Please note that if the remitter’s bank has a US presence, certain protocols may apply, ensuring compliance and smooth processing for all cross-border transactions. This comprehensive approach to transfers solidifies Popular Bank's position as a versatile and reliable financial partner.

Opening New Accounts: Your Path to Financial Growth with Popular Bank

Embarking on a new financial journey often begins with opening the right account. Popular Bank offers a variety of options tailored to different needs, from basic checking accounts to more specialized savings and investment vehicles. The process is designed to be accessible, whether you prefer an in-person consultation or the convenience of online application.

To open a new account, you have the flexibility to visit your local Popular branch, where experienced staff can guide you through the options and help you choose the best fit for your financial goals. This personalized approach ensures that all your questions are answered and you feel confident in your choices. Alternatively, for those who prefer digital convenience, you can click here to learn more about the checking account we offer and potentially initiate the application online. This dual approach caters to a wide range of customer preferences, reinforcing Popular Bank's commitment to accessibility.

Finding your nearest branch is also made easy. You can use the ATM & Branch Locator tool, a convenient feature available on Popular Bank's website or mobile app. This tool allows you to quickly locate branches and ATMs, complete with addresses and operating hours, such as the Banco Popular at Señorial Center Building, Attn, Lomas Verde PR 177 Esq., ensuring you can always find a physical location when needed. This seamless integration of online and in-person services highlights how Popular Bank strives to provide a comprehensive and user-friendly experience for all its customers, making it a truly popular bank choice for many.

ATM Access and Fees: Navigating Your Cash Needs

While digital transactions are increasingly prevalent, cash remains a vital part of many people's financial lives. A popular bank understands the importance of convenient ATM access, but also transparently communicates any associated fees, especially when using non-network ATMs. Popular Bank aims to provide clarity on these charges to help you manage your cash withdrawals effectively.

When you withdraw cash from a different bank's ATM, a $2 fee applies for every withdrawal or balance inquiry. This is a standard charge that Popular Bank levies for using out-of-network machines. It's important to be aware of this fee to avoid unexpected deductions from your account. Furthermore, it's crucial to remember that the owner of the ATM may also require additional fees, specified at the time of the transaction. These surcharges are imposed by the third-party ATM operator, not Popular Bank, and can vary. Always review the on-screen prompts carefully before completing a transaction at a non-Popular Bank ATM to understand the total cost. To minimize these fees, Popular Bank encourages the use of its extensive network of ATMs, which can be easily located using the ATM & Branch Locator, ensuring cost-effective access to your funds. This transparency about fees is another aspect that contributes to Popular Bank's reputation as a trustworthy and popular bank.

Unparalleled Customer Support: The Popular Bank Difference

Exceptional customer support is a hallmark of any truly popular bank. When you have questions, encounter an issue, or simply need guidance, knowing that reliable help is readily available provides immense peace of mind. Popular Bank prides itself on offering multiple channels for support, ensuring that assistance is always within reach.

The Popular Bank Help Center is an invaluable resource, allowing you to easily find answers to frequently asked questions about our banking services and products. This online portal is designed for self-service, offering a wealth of information on topics ranging from account management to digital banking features, often providing immediate solutions to common queries.

For more personalized assistance, Popular Bank offers robust telephone banking and a dedicated customer care center. With this number, you can reach knowledgeable representatives who are ready to assist you with a wide array of banking needs. Customer care representatives are available Monday through Friday from 7:30 AM to ensure that you have access to expert help during standard business hours. This commitment to accessible and responsive support, whether through digital resources or direct human interaction, reinforces Popular Bank's dedication to its customers and its standing as a popular bank choice.

Security and Trust: Safeguarding Your Finances with Popular Bank

In the digital age, the security of your financial information is paramount. A popular bank doesn't just offer convenient services; it also provides robust security measures to protect your assets and personal data. Popular Bank employs advanced encryption technologies and multi-factor authentication protocols to safeguard your online and mobile banking activities. This includes secure login procedures, real-time fraud monitoring, and alerts for unusual account activity, ensuring that any potential threats are identified and addressed swiftly.

Beyond technological safeguards, Popular Bank also educates its customers on best practices for online security, empowering them to be proactive in protecting their accounts. This commitment to both technological and educational security measures builds a foundation of trust, which is essential for any financial institution aiming to be a popular bank. Knowing that your money and information are protected allows you to use Popular Bank's services with confidence and peace of mind.

Why Choose Popular Bank? A Holistic Approach to Banking

Choosing a bank is a significant decision that impacts your daily financial life and long-term goals. Popular Bank distinguishes itself through a holistic approach to banking that prioritizes customer needs, technological innovation, and community engagement. It's not just about transactions; it's about building a relationship that supports your financial well-being. The seamless integration of online and mobile banking, coupled with accessible in-person services, provides unparalleled flexibility. Whether you prefer managing your accounts from your smartphone or visiting a local branch for personalized advice, Popular Bank caters to your preference.

The comprehensive range of services, from diverse account options like checking accounts, CDs, and lines of credit, to efficient money transfer capabilities, ensures that all your financial requirements are met under one roof. Furthermore, the transparent fee structures, particularly regarding ATM usage, demonstrate a commitment to clarity and honesty, fostering trust with its clientele. Popular Bank's dedication to robust customer support, available through various channels including a responsive help center and a dedicated customer care line, means that assistance is always at hand when you need it most. This blend of convenience, comprehensive services, transparency, and reliable support solidifies Popular Bank's reputation as a genuinely popular bank, consistently meeting and exceeding the expectations of its diverse customer base.

The Future of Banking: Innovation at Popular Bank

The financial industry is constantly evolving, driven by technological advancements and changing consumer expectations. A truly popular bank remains at the forefront of this evolution, continuously innovating to offer more intuitive, secure, and personalized banking experiences. Popular Bank is committed to investing in cutting-edge technologies that not only enhance existing services but also introduce new features designed to simplify financial management even further. This includes exploring advanced analytics for personalized financial insights, integrating AI for more intelligent customer service interactions, and enhancing cybersecurity measures to stay ahead of emerging threats.

The focus remains on creating a banking ecosystem that is proactive in meeting customer needs, anticipating future trends, and providing tools that empower individuals to achieve their financial aspirations with greater ease and confidence. By consistently adapting and embracing innovation, Popular Bank aims to remain a leading and popular bank, dedicated to serving its customers with the best possible financial solutions for today and tomorrow.

Conclusion

Navigating the complexities of personal finance requires a reliable and forward-thinking partner. Popular Bank stands out as a beacon of modern banking, offering a comprehensive suite of services designed to simplify your financial life. From the ease of enrolling in online banking with your ATM/debit card information to the convenience of instantly transferring money between your Popular accounts, every feature is crafted with the user in mind. The ability to deposit checks effortlessly via the Popular Mobile Banking App, coupled with clear guidance on external transfers and ATM fees, underscores a commitment to transparency and user empowerment.

With accessible customer care representatives available Monday through Friday from 7:30 AM, and a robust online help center, Popular Bank ensures that support is always within reach. Whether you choose to open a new account at a local branch like Banco Popular at Señorial Center Building or through their user-friendly online portal, Popular Bank provides the tools and support you need for a secure and efficient financial journey. We encourage you to explore the myriad of services offered by Popular Bank to see how they can streamline your financial management. What features of Popular Bank do you find most valuable? Share your thoughts in the comments below, or explore more of our articles on optimizing your banking experience.

Popular (From The Idol Vol. 1 (Music from the HBO Original Series

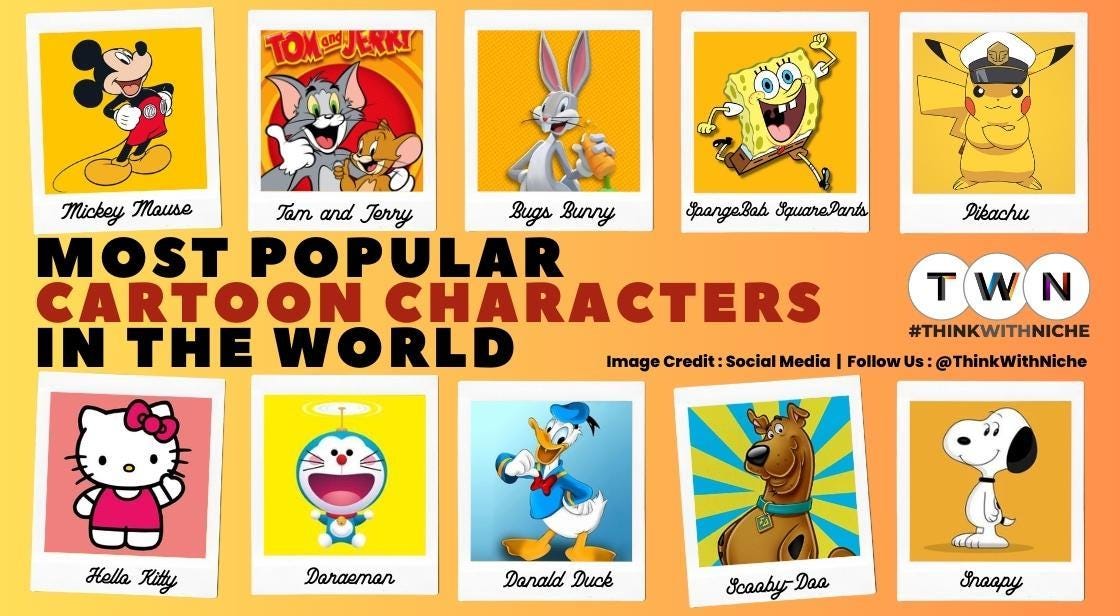

Most Popular Cartoon Characters in the world | by Think With Niche | Medium

What Are The Top 5 Most Popular Apps at Mark Briganti blog