Understanding The Crucial Role Of A Title Bureau

When embarking on the significant journey of buying or selling property, whether it's a cherished family home or a sprawling commercial complex, the sheer volume of legal and financial intricacies can be overwhelming. Amidst this complexity, one entity stands as a pivotal guardian of your investment: the title bureau. Often operating behind the scenes, these specialized firms are indispensable in ensuring that property transactions are not only legitimate but also secure, protecting both buyers and sellers from potential legal quagmires and financial pitfalls. Without their meticulous work, the very concept of clear property ownership, which is the cornerstone of real estate, would be fraught with unbearable risk.

The term "title" itself carries multiple meanings, from a distinguishing name for a production to a formal designation preceding a person's name, signifying rank or position. However, in the realm of real estate, "title" takes on its most critical definition: it signifies the legal ownership of a property or asset, be it a house, a car, a trademark, or a patent. This legal concept of ownership is what a title bureau is primarily concerned with, meticulously verifying its integrity and ensuring its smooth transfer. Their role is not merely administrative; it is foundational to the stability and trustworthiness of the entire real estate market, safeguarding one of the most significant financial decisions many individuals and businesses will ever make.

Table of Contents

- The Essence of Title: More Than Just a Name

- What Exactly is a Title Bureau?

- Why a Title Bureau is Indispensable for Real Estate Transactions

- Navigating the Complexities: The Role of Title Insurance

- The Critical Function of Escrow Services

- Beyond the Basics: Additional Services Offered

- Choosing the Right Title Bureau: What to Look For

- The Future of Title Services: Technology and Trust

The Essence of Title: More Than Just a Name

In the context of real estate, the term "title" transcends its everyday usage as a distinguishing name or a professional designation. Here, "title" is the legal concept of ownership, the irrefutable right to possess, use, and dispose of a property. It's the ultimate proof that you are the rightful owner of a piece of land, a house, or any other real property. This concept is fundamental to property law and underpins every real estate transaction. Without a clear and undisputed title, the very foundation of property ownership becomes shaky, opening the door to potential disputes, claims, and significant financial losses. The importance of a clear title cannot be overstated. Imagine investing your life savings into a home, only to discover later that a distant relative of the previous owner has a legitimate claim to the property, or that there's an undisclosed lien from a past debt. These are not mere hypothetical scenarios; they are real risks that can arise from defects in a property's title history. A "defect" in a title refers to any outstanding claim, lien, or encumbrance that could potentially affect the owner's legal rights to the property. This could include unpaid taxes, unreleased mortgages, judgments against previous owners, or even errors in public records. The comprehensive work performed by a title bureau is precisely designed to uncover and resolve such issues before they become a buyer's problem.Title vs. Deed: Unpacking the Difference

It's common for individuals to use "title" and "deed" interchangeably, but this is a critical misunderstanding that a reputable title bureau can help clarify. While both are integral to property ownership, they represent distinct aspects: * **Title:** As established, title is the legal concept of ownership. It is an abstract right, not a physical document. It signifies the sum of all legal rights one has to a property. When we say someone "holds title," we mean they possess the legal right to ownership. * **Deed:** A deed, on the other hand, is a physical legal document that formally transfers title (ownership) from one party (the grantor) to another (the grantee). It is the written instrument that conveys the legal rights associated with the title. Think of the deed as the receipt or the evidence of the transfer of title. Therefore, while a deed is a crucial document in the transfer process, it is merely the vehicle through which title is conveyed. The title itself is the underlying legal right. A property can have a deed, but if there are defects in the chain of title (the historical record of ownership), the legal ownership conveyed by that deed might be compromised. This distinction highlights why the meticulous examination performed by a title bureau is so vital. They don't just ensure the deed is correctly executed; they delve into the entire history of the property's title to ensure its integrity.What Exactly is a Title Bureau?

A title bureau, often interchangeably referred to as a title company, is a specialized firm that plays a critical role in real estate transactions by ensuring the legal transfer of property ownership. Their primary function is to investigate the history of a property's title to identify any potential issues or "clouds" that could jeopardize clear ownership. This investigation, known as a title search, involves meticulously examining public records related to the property, including deeds, mortgages, liens, judgments, tax records, and probate documents. The goal is to provide a comprehensive report on the property's ownership status, revealing any encumbrances or claims that could affect the buyer's rights. Beyond the investigative work, a title bureau also acts as an impartial third party, facilitating the closing process and often providing title insurance. Their expertise lies in understanding the complex web of property laws, local regulations, and historical records that govern real estate. Companies like Core Title Group (previously known as Western Title in Nevada) and Stewart Title Northern Nevada exemplify the scope of services offered by such bureaus, ranging from residential to complex commercial transactions. They are the gatekeepers of secure property transfers, offering peace of mind to all parties involved.Core Services of a Title Bureau

The range of services offered by a title bureau is extensive, all designed to ensure a smooth, secure, and legally sound property transaction. The core offerings typically include: * **Title Search:** This is the foundational service. A title bureau's expert team delves into public records to trace the property's ownership history, identify any liens, easements, judgments, or other encumbrances that might affect the title. This thorough examination is crucial for uncovering potential issues before they escalate. * **Title Examination:** Following the search, a title examiner reviews all the collected documents to determine the property's legal ownership status and identify any "defects" or "clouds" on the title. This includes verifying the accuracy of legal descriptions, ensuring proper execution of past deeds, and confirming the satisfaction of all prior mortgages or liens. * **Title Insurance:** Perhaps one of the most vital services, title insurance protects both the buyer (owner's policy) and the lender (lender's policy) against financial loss due to defects in the title that were not discovered during the title search. This insurance provides a critical safety net, covering legal fees and losses if a claim against the title arises after the transaction is complete. Texas Title, for instance, emphasizes their business is to provide title insurance to their customers, understanding their requirements and delivering policies on time. * **Closing and Escrow Services:** Many title bureaus also serve as the escrow agent, holding all funds and documents related to the transaction in a neutral third-party account until all conditions of the sale are met. They manage the exchange of funds, the signing of documents, and the recording of the deed, ensuring that all legal and financial requirements are satisfied before the property officially changes hands. This impartial role is crucial for maintaining trust and transparency throughout the closing process.Why a Title Bureau is Indispensable for Real Estate Transactions

The acquisition or sale of real property represents one of the most significant financial transactions most individuals or businesses will undertake. The stakes are incredibly high, involving substantial sums of money and long-term financial commitments. This is precisely why a title bureau is not just a convenience but an indispensable partner in every real estate deal. Their role extends far beyond mere paperwork; they are the frontline defenders against a myriad of potential legal and financial disasters that could otherwise derail a transaction or, worse, lead to devastating post-closing complications. Consider the complexity of property records. Over decades, or even centuries, a single property can change hands numerous times, undergo various subdivisions, be subject to multiple mortgages, easements, and liens. Errors can occur at any stage: misspellings, incorrect legal descriptions, unrecorded documents, or even fraudulent transfers. Without a thorough investigation by a specialized entity, these hidden issues could lie dormant, only to emerge years later, challenging your ownership and potentially costing you hundreds of thousands of dollars in legal fees and losses. A title bureau acts as a diligent detective, meticulously sifting through historical data to construct a complete and accurate picture of the property's ownership lineage. They identify and work to resolve any "clouds on title" – issues that could impair or invalidate ownership. This proactive problem-solving is invaluable. For instance, if an old, unreleased mortgage is discovered, the title bureau will work to get it properly discharged. If there's an outstanding judgment against a previous owner that could attach to the property, they will flag it and ensure it's addressed. This level of due diligence provides an unparalleled layer of security, safeguarding the buyer's investment and ensuring the seller can convey a clear title. Furthermore, in an era where digital information is prevalent, the human expertise offered by a title bureau remains irreplaceable. While databases can provide vast amounts of information, the nuanced interpretation of legal documents, the understanding of local property laws, and the ability to navigate complex historical records require the seasoned judgment of experienced title professionals. Companies like Capital Title of Texas, which has grown to be the largest independent title company in the United States, exemplify how deep-rooted expertise and a commitment to service are paramount in protecting property rights. Their extensive experience since 1991 underscores the long-standing need for specialized title services to ensure safe and successful real estate transactions.Navigating the Complexities: The Role of Title Insurance

While a meticulous title search aims to uncover all existing defects, the reality is that some issues may be hidden or arise from circumstances not discoverable through public records. This is where title insurance steps in as a critical safeguard, offering protection against unforeseen challenges to property ownership. Unlike other forms of insurance that protect against future events (like fire or theft), title insurance protects against past events that could affect the title to the property. It is a one-time premium paid at closing, providing coverage for as long as the insured or their heirs own the property. There are two primary types of title insurance policies: * **Owner's Policy:** This policy protects the buyer (the new property owner) against financial loss and legal expenses due to title defects that existed prior to the purchase but were unknown at the time. This could include issues like forged documents, undisclosed heirs, errors in public records, or previously unknown liens. If a claim arises, the title insurance company will defend the owner's title in court and cover any losses up to the policy amount. * **Lender's Policy:** This policy protects the mortgage lender's investment. Most lenders require a lender's policy to ensure that their loan is secured by a valid first lien on the property. If a title defect emerges that affects the lender's priority, this policy protects the lender's financial interest. The peace of mind provided by title insurance is immense. It transforms a potentially risky investment into a secure asset, knowing that a professional entity stands ready to defend your ownership rights. As Texas Title aptly puts it, their business is to provide title insurance to customers, understanding their requirements and delivering policies on time, every time, protecting property rights since 1991. This commitment highlights the industry's dedication to ensuring the integrity of property ownership.Residential vs. Commercial Title Services

While the fundamental principles of title examination and insurance remain consistent, the complexities involved in residential and commercial real estate transactions can differ significantly, leading title bureaus to offer specialized services tailored to each. * **Residential Title Services:** These typically involve single-family homes, condominiums, and smaller multi-unit dwellings. While still requiring thoroughness, the title chains are often simpler, and the parties involved are usually individuals. Services include title insurance, closing and escrow services, and often guidance for first-time homebuyers. The focus is on ensuring a smooth, understandable process for consumers making a significant personal investment. * **Commercial Title Services:** Commercial real estate transactions are often far more intricate. They can involve large-scale developments, multi-parcel acquisitions, complex financing structures, and a multitude of stakeholders. The title search might need to uncover easements for utilities, zoning restrictions, environmental liens, or specific development agreements. Title bureaus serving commercial clients, such as those providing services for acquisitions, dispositions, refinancing, and note sales, require a broad range of experience and an expert team capable of delivering innovative solutions. Their commitment to quality and timeliness helps consumers limit their exposure to risks in high-value, complex deals.The Critical Function of Escrow Services

Beyond verifying title and providing insurance, many title bureaus also serve as the escrow agent in a real estate transaction. This role is absolutely critical for ensuring a fair, secure, and orderly closing process for both buyer and seller. Escrow refers to the process where a neutral third party (the escrow agent, often the title bureau) holds all funds and documents related to the transaction until all conditions of the sale agreement have been met. Imagine a scenario without an escrow agent: the buyer might be hesitant to hand over a large sum of money before being absolutely certain they have legal ownership, and the seller might be unwilling to sign over the deed before receiving payment. This creates a classic "chicken and egg" dilemma. The escrow agent resolves this by acting as a trusted intermediary. Here's how it generally works: * **Holding Funds and Documents:** The buyer deposits the earnest money and later the full purchase price into an escrow account. The seller deposits the signed deed and other necessary documents. * **Fulfilling Conditions:** The escrow agent ensures that all conditions stipulated in the purchase agreement are satisfied. This includes receiving the loan documents from the lender, ensuring all necessary inspections are completed, obtaining clear title, and confirming that all contingencies are met. * **Disbursement and Recording:** Once all conditions are fulfilled, the escrow agent disburses the funds to the seller, pays off any existing liens or mortgages, covers closing costs, and ensures the new deed is properly recorded with the county recorder's office. This recording is what makes the transfer of ownership public and legally binding. The escrow process provides an invaluable layer of security, transparency, and accountability. It ensures that neither party is exposed to undue risk during the often-lengthy period between the agreement of sale and the final closing. The impartiality of the title bureau as an escrow agent is paramount, ensuring that the transaction proceeds according to the agreed-upon terms and legal requirements, protecting the financial interests of all parties.Beyond the Basics: Additional Services Offered

While title insurance, title searches, and escrow services form the bedrock of a title bureau's offerings, many progressive companies provide a broader suite of services designed to cater to the diverse needs of the real estate community. These additional services further solidify the title bureau's role as a comprehensive partner in property transactions. For instance, companies like Alamo Title of Texas offer services in commercial and residential titles, closing and escrow, and even realtor education in Dallas, Texas. This demonstrates a commitment to not just facilitating transactions but also empowering real estate professionals with the knowledge they need. Providence Title, founded in 2008, specifically aimed to address the need for a more personal approach to title insurance in Texas, focusing on building local relationships, which often translates into more tailored and responsive service offerings.Specialised Transactions: 1031 Exchanges and Construction Disbursing

Beyond standard residential and commercial closings, title bureaus often handle more specialized and complex transactions: * **1031 Property Exchanges:** Also known as a like-kind exchange, a 1031 exchange allows investors to defer capital gains taxes on the sale of an investment property if they reinvest the proceeds into a similar property within a specific timeframe. This process is highly regulated and requires a qualified intermediary to hold the funds. Many title bureaus offer this service, acting as the neutral third party to ensure compliance with IRS regulations and facilitate the complex exchange process. This service is crucial for real estate investors looking to optimize their portfolio and tax liabilities. * **Construction Disbursing:** For new construction projects, title bureaus often provide construction disbursing services. In this arrangement, the title company manages the distribution of construction loan funds to contractors, subcontractors, and suppliers as work progresses. This ensures that funds are released only when specific milestones are met and that all parties are paid, thereby preventing mechanic's liens from being filed against the property. This service provides a vital layer of financial control and risk mitigation for developers and lenders alike. These specialized services highlight the adaptability and extensive expertise within the title industry, demonstrating how a title bureau can be a multifaceted partner, addressing intricate financial and legal requirements beyond simple property transfers.Choosing the Right Title Bureau: What to Look For

Given the critical role a title bureau plays in protecting your significant investment, selecting the right one is paramount. It's not just about finding "title companies in Dayton, NV" or Dallas-Fort Worth; it's about identifying a partner that embodies expertise, reliability, and a commitment to client protection. Here are key factors to consider: * **Experience and Reputation:** Look for a bureau with a long-standing history and a strong reputation in the community. Companies that have been "protecting property rights since 1991" or have grown to be "the largest independent title company in the United States" (like Capital Title of Texas) often signify reliability and deep industry knowledge. Online reviews and local referrals can also provide valuable insights. * **Comprehensive Services:** Ensure the bureau offers the full suite of services you need, including thorough title searches, title insurance, and robust escrow services. If you have specialized needs, such as a 1031 exchange or commercial closing, confirm they have specific expertise in those areas. * **Underwriter Relationships:** A strong title bureau will work with multiple major underwriters in the US. As Independence Title states, "This gives us superpowers when it comes to closing complicated transactions." This access to various underwriters provides flexibility and ensures that they can find the best coverage and solutions for unique situations. * **Local Expertise and Relationships:** While national reach is valuable, local knowledge is often critical. A bureau with strong local relationships, as Providence Title emphasizes, can navigate regional nuances, understand local market conditions, and have established connections that facilitate smoother closings. * **Customer Service and Communication:** Real estate transactions can be stressful. Choose a title bureau that prioritizes clear, timely communication and a personal approach. Their commitment to "quality and timeliness" helps consumers limit their stress and ensures they are kept informed every step of the way. An expert team that delivers innovative solutions and is responsive to your requirements is invaluable. * **Technology Integration:** While human expertise is crucial, modern title bureaus leverage technology to enhance efficiency, accuracy, and communication. Ask about their digital capabilities for document signing, secure communication, and tracking transaction progress. By carefully evaluating these factors, you can select a title bureau that will serve as a trusted guardian of your property transaction, ensuring peace of mind and the secure transfer of your valuable assets.The Future of Title Services: Technology and Trust

The real estate industry, including the vital sector of title services, is continually evolving. While the core principles of verifying ownership and mitigating risk remain constant, the methods and tools employed by a title bureau are increasingly influenced by technological advancements. The future of title services will likely see a greater integration of digital solutions, further enhancing efficiency, transparency, and accessibility, while still preserving the human element of trust and expertise. Blockchain technology, for instance, holds significant promise for creating immutable, transparent, and decentralized records of property ownership. While full implementation is still a distant prospect, pilot programs are exploring how blockchain could streamline title searches and reduce the potential for fraud. Similarly, advancements in artificial intelligence and machine learning could automate aspects of document review, speeding up the title examination process and flagging potential issues with greater precision. Digital closing platforms, electronic signatures, and secure online portals are already becoming standard, making the transaction process more convenient for all parties. However, despite these technological leaps, the fundamental role of a title bureau will remain indispensable. Technology can enhance processes, but it cannot replace the nuanced judgment, legal expertise, and human interaction required to resolve complex title issues, interpret intricate legal documents, or provide personalized customer service. The "personal approach to title insurance" that Providence Title championed, or the "superpowers when it comes to closing complicated transactions" that Independence Title boasts through its underwriter relationships, are testaments to the enduring value of human expertise and established networks. The future of title services will be a synergy of cutting-edge technology and time-honored trust. A reputable title bureau will continue to be the essential intermediary, ensuring that property rights are protected, transactions are secure, and the cornerstone of a safe and successful real estate market remains solid. They will adapt to new challenges and opportunities, always with the primary goal of safeguarding the legal ownership of property, which is paramount to financial security and peace of mind for individuals and businesses alike.Conclusion

The journey of buying or selling real estate is complex, fraught with legal and financial intricacies that demand expert navigation. At the heart of this process lies the title bureau, an unsung hero that meticulously safeguards one of your most significant investments. From conducting exhaustive title searches to providing crucial title insurance and facilitating secure escrow services, their role is not merely administrative but foundational to the integrity and stability of every property transaction. They are the guardians of legal ownership, ensuring that the concept of "title" – the undisputed right to your property – remains clear, secure, and unchallengeable. As we've explored, a title bureau does far more than just process paperwork; they mitigate risks, resolve historical ambiguities, and protect you from potential financial ruin. Whether you're a first-time homebuyer or a seasoned commercial investor, partnering with a reputable title bureau is not an option but a necessity. Their expertise, authoritative knowledge, and unwavering commitment to trustworthiness are the pillars upon which secure property ownership is built. Don't leave your most valuable asset to chance. When you embark on your next real estate venture, make sure a trusted title bureau is your first call. Have you ever experienced a complex property transaction? Share your insights and questions in the comments below, or explore more articles on our site to deepen your understanding of real estate essentials.

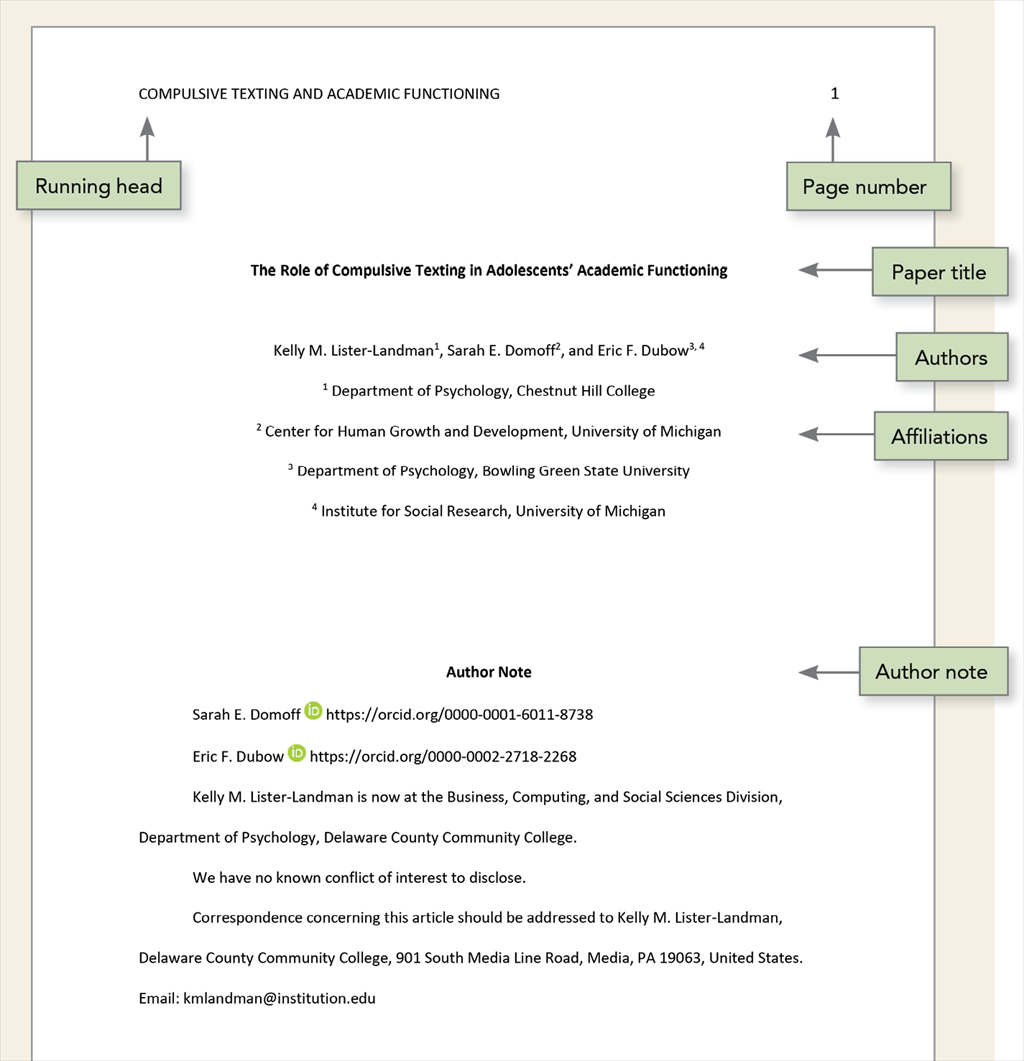

Apa Cover Page Format

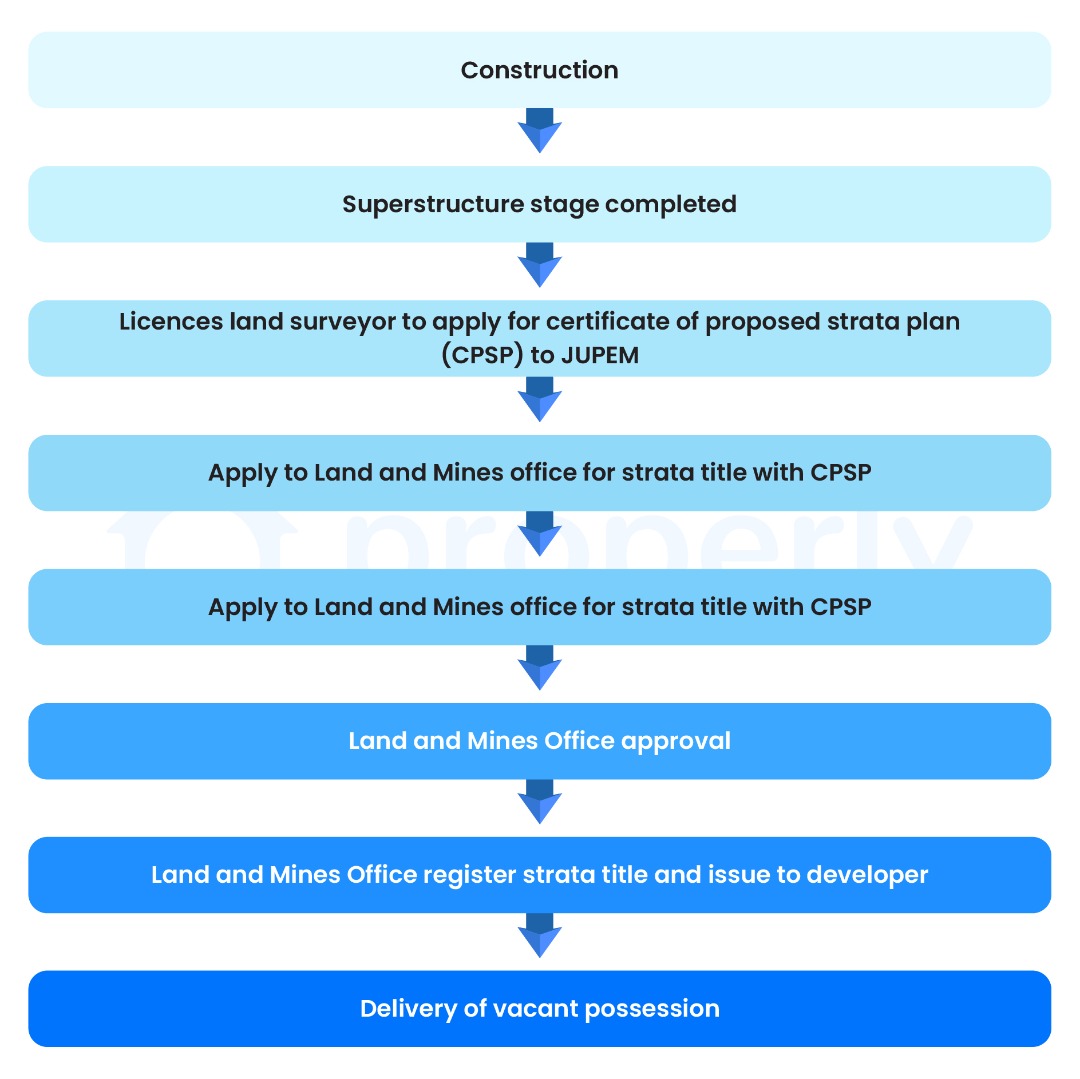

Strata Title vs Individual Title: Know The Differences (And Your Rights

Check out the NEW Undisputed WWE Universal Title - Sportnow